Find a better market position with portfolio analysis charts

How much do You know about Your product portfolio? Do You know exactly which of Your products are in which stage of life?

Do You know which areas are growing and which

are profitable? Do You know whether it is desirable

to strive for market leadership, to seek partners

or to increase investment? Do You know whether certain

products should better be given up? Such issues

are often visualized with portfolio diagrams.

The

word "portfolio" can be traced back to Latin. Taken

literally, a portfolio serves to carry leaves: It

is a wallet. Today, the word is used in manifold

context when one speaks of a collection of similar

things. Most probably you will hear it in the context

of securities: A vault's content is often referred

to as a stock portfolio.

The

word "portfolio" can be traced back to Latin. Taken

literally, a portfolio serves to carry leaves: It

is a wallet. Today, the word is used in manifold

context when one speaks of a collection of similar

things. Most probably you will hear it in the context

of securities: A vault's content is often referred

to as a stock portfolio.

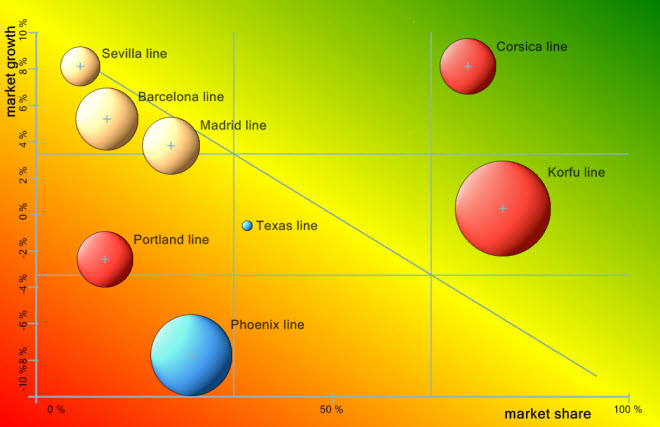

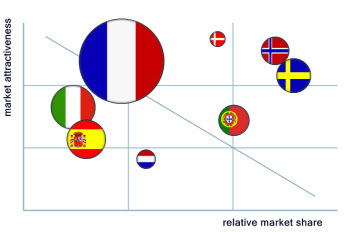

Strategic portfolio

analysis starts with similar things. This could

be a portfolio of products, industries or markets,

for instances. It is about the things by which to

make money. Usually we use the term portfolio diagram

when, as shown in the image, the considered subjects

are classified according to certain criteria. The

subjects are grouped and "similar things" are investigated.

Often we look for relationships, interactions and

developments.

Strategic decisions

In the heart of the matter this is about strategic

decisions. It is about the search of the best starting

points for product development and investment. For

example, we confront the two terms "competitive

advantage" and "market attractiveness" and use the

corresponding graph to classify our products. Portfolio

strategy is then what we make of it.

Put

more simply, we ask: In what area and what products

are we better than everyone else, closer to the

customer's requirements? To which products apply

both advantages? How can we earn more?

Which diagrams exactly?

Of course, portfolio diagrams can be found among

the strategy charts provided by meineZIELE pro,

where they can be created quickly and in unlimited

variety. However, less is often more. Therefore,

this important principle in advance: Portfolio diagrams

are only worth something if they answer our questions

and if we get into a position where we can act based

on insights. Do not start by trying to paint a colourful

image. First specify what question has to be answered

with your chart. The diagram itself can be very

simple.

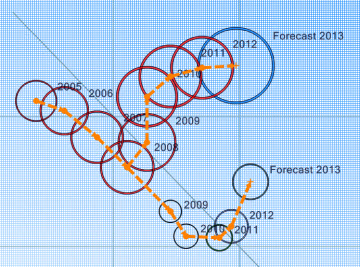

Portfolio

diagrams help you clarify the positioning and development

of products, markets and target audiences. They

allow a high density of information in multiple

dimensions and sometimes act as clearing as windshield

wipers.

Portfolio

diagrams help you clarify the positioning and development

of products, markets and target audiences. They

allow a high density of information in multiple

dimensions and sometimes act as clearing as windshield

wipers.

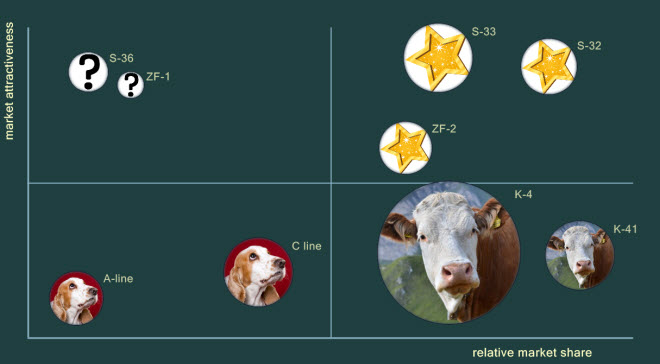

Anyone who knows about portfolio

strategy has at least one special, simple outline

in mind: The famous dogs, stars, cash cows, and

question marks from the portfolio analysis by the

Boston Consulting Group.

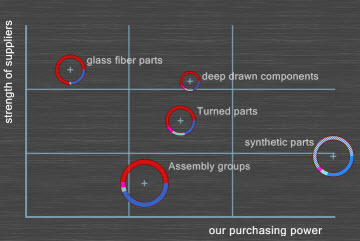

Portfolio analyses are based on many different

considerations. Example: In some parts of the purchasing,

we can easily dictate prices, in others we have

to be happy if everything is delivered on time.

Some suppliers are important to us, others are not.

Or: With some products we make the money, others

will only be profitable in the coming years and

are still loss-making today.

So,

portfolios can be used in various areas. We then

speak of product, procurement, technology or employee

portfolios. And of course there are many other applications

and special considerations such as "early warning

portfolios". Hence, it is interesting that in some

situations actually something like "recipes" are

available.

So,

portfolios can be used in various areas. We then

speak of product, procurement, technology or employee

portfolios. And of course there are many other applications

and special considerations such as "early warning

portfolios". Hence, it is interesting that in some

situations actually something like "recipes" are

available.

For example, the purchasing portfolio

on the right shows that there is a procurement risk

in plastics. We would actively seek for new suppliers,

agree scheduled orders and establish stockpiles.

For the modules, however, we would keep low stocks

and max the prices. Once recognized the situation,

we would have the portfolio in mind, and then we

could act basically according to the book. Literature

about strategy and controlling are available by

the pile.

Where does meineZIELE come in?

The

example of the Boston Consulting Group shows how

simple things sometimes have to be represented if

one wants to be understood. Just the simplicity

of the approaches forces a concentrated view of

the so-called key variables. For strategic decisions

the crucial strengths and weaknesses have to be

known. At the portfolio approach, the question is:

Which business sectors have such key strengths and

which do not? Where are actual investment opportunities

and where not?

The

example of the Boston Consulting Group shows how

simple things sometimes have to be represented if

one wants to be understood. Just the simplicity

of the approaches forces a concentrated view of

the so-called key variables. For strategic decisions

the crucial strengths and weaknesses have to be

known. At the portfolio approach, the question is:

Which business sectors have such key strengths and

which do not? Where are actual investment opportunities

and where not?

The idea is to identify these

facts and to show them to oneself and others. Anyone

how has seen and understood a portfolio once will

mostly be able to make reasonable decisions without

textbook. Therefore, meineZIELE does not provide

the recipes, but will assist you in the presentation

of findings and their implementation in actions.

The often tedious data procurement on markets

and competitors is not supported as well. However,

meineZIELE helps you get these data and findings

in an engaging and understandable form. That is

what matters.

Example: Portfolio strategy of the BCG

The famous dogs and cows indicated in many

textbooks come from the Boston Consulting Group

(BCG), an international strategy consulting company.

The model of the BCG considers the product life

cycle in a graph which applies market growth to

market share. To the top left you will find still

new products, the so-called question marks, which

require careful selection. These are not yet financeable

with their earnings and many of them can turn out

to be flops.

To the top right there are already established

products. With a high market share in a rapidly

growing market, they are actually the stars. They

have left the stage of uncertainty. Investments

are worthwhile.

To the bottom right, at a

high market share in a saturated market one skims

what the market will bear. The cash cow is the right

image for that.

Finally, there are the poor

dogs to the bottom left. Low growth and low market

share suggest gradually taking these products from

the market.

Of course, there is a lot of

academic controversy about where the dividing line

between the segments has to be drawn and whether

the market share shall be absolute or relative.

The user can choose by himself. The labels and scale

of the graph are freely adjustable. (Recommended

reading: "The Boston Consulting Group On Strategy")

From insight to action

Actually,

it is not difficult to cobble together portfolio

diagrams using any graphics software. But there

are some outstanding features and comfortable, convenient

display options, which make meineZIELE the top choice

for developing portfolio strategy.

Actually,

it is not difficult to cobble together portfolio

diagrams using any graphics software. But there

are some outstanding features and comfortable, convenient

display options, which make meineZIELE the top choice

for developing portfolio strategy.

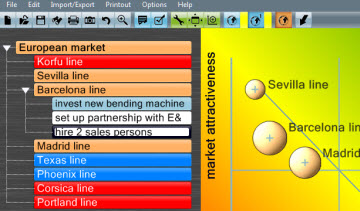

You could

probably find elaborated but never implemented strategies

in some drawer of virtually every company. Not with

mZ Pro. In mZ Pro a portfolio consideration (and

all other strategic planning) is directly included

in Your outline of projects, goals and tasks.

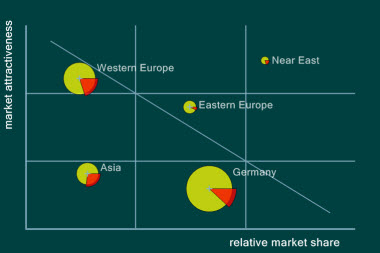

In meineZIELE, the portfolio elements are directly

connected with the structured entries. You can take

measures concerning the displayed elements and include

them in the outline as a subordinate goal. Two mouse

clicks activate the task and bring it to the daily

schedule. Switch from theoretical insights to powerful

action in a single second.

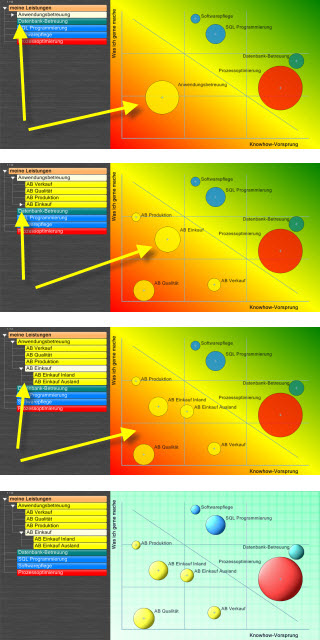

Hierarchical portfolios

Even the portfolio itself may be hierarchical.

In the figure to the right you can see how easy

an element is broken into its components with two

mouse clicks. That is ideal for discussions with

the portfolio on the canvas.

The knowledge

gain can be enormous with hierarchical portfolios.

That is because sometimes little market segments,

which would be put somewhere else generously, lie

in a completely different area of the diagram and

require a different strategic response.

Design options

With meineZIELE, a portfolio diagram can be designed

any colorful or conservative. Also the portfolio

circles themselves can have a number of different

properties.

The position of a circle could

indicate the market share and growth opportunities

of a product. Then you could choose the size of

the circle for the sales, colours for different

product groups, and so on.

If the circles

lie close together or overlap each other, it is

often advantageous to choose rings. Using sectors

or ring segments, even the sales share of the main

product or a product group can be highlighted.

Remember, however: Any information is only worth

something when it allows us to act. And a graph

is at its best when nothing can be left out anymore.

In any case, meineZIELE provides all the options.